Which healthcare plan should I choose?

Background

As someone new to the whole healthcare system, I often do not know which healthcare options to go with when it involves HSA/FSA, deductible, copay, company matches, etc. In the attempt to find the best choice for the healthcare plan, I spent a few hours creating a shiny app for everyone to modify for their own purposes. You can find the app here and the code here

How I used this

The app will ask you to put in the specific information for different plans you have, including deductible, out of pocket max, premiums each month, coinsurance and if you use HSA, and company’s match on HSA. The placeholder information is all simulated.

The overall goal is to present the overall possible cost at different medical bill scenarios. Please note the tax benefits of using HSA are not considered money-saving here.

After I have input the specific info, I can press compare to view how the different plans would stack up and what would be a recommended plan in specific cost ranges separated by $1,000.

Lessons learned

Looking back, the main lessons learned were not around shiny or coding but how to present information in a way that would help people make a decision.

When I first saw the different plans presented, I was lost. I did not understand what type of costs would a doctor visit involve in the first place. After I get to know the typical costs, I was still lost. My brain simply cannot do all the math for different options and decide which plan would cost the least, let alone determine the best amount to put in HSA, if that is an option.

After complaining about how difficult it was for me to weigh the options, I came to realize that I need to lay out all scenarios along with the costs and compare them. That led me to the following steps to create this app.

Step1 – identify the goal

For me, I care about the costs. Therefore, the goal is to identify my possible spending in different scenarios. In general, my spending will be medical bill + premium payment + HSA contribution (if not 0).

Step2 – normalize the scenarios

I won’t know how many doctor visits I would need next year, thus it is difficult to predict the actual costs. But it may not matter at all, as we could simulate all costs bracket and calculate my spending. That way, it would be rather clear what the best plan would be at different costs brackets.

Step3 – fill in assumptions

Well, there is uncertainty like in-network vs out-network. To further normalize the scenarios, I assumed I would stick with in-network for all visits in my calculation. If you want to add that comparison in your own exploration, you could assign a proportion to out-of-network visits.

Step4 – visualize results

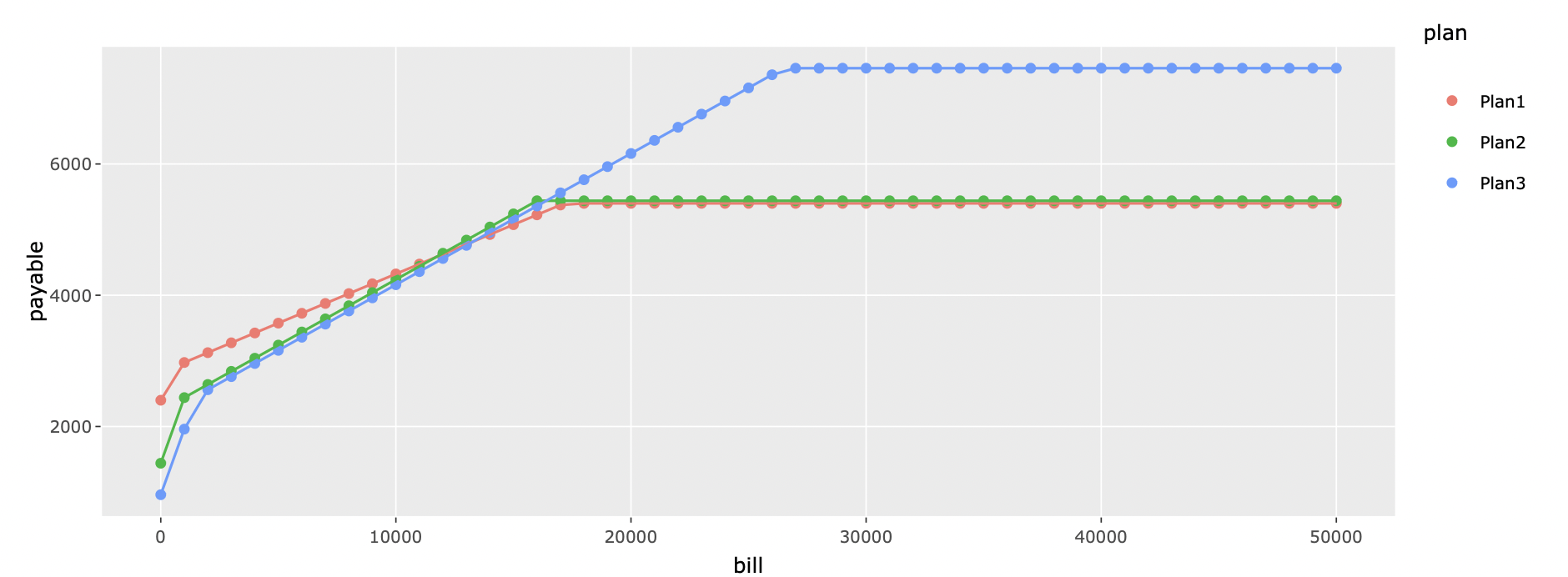

After all the calculations are done, I want a quick and easy way to see which plan is the best. Therefore, I have created the chart of bills vs spending below with simulated data. On this chart, I would identify my potential bill range and find the line closest to the x-axis.

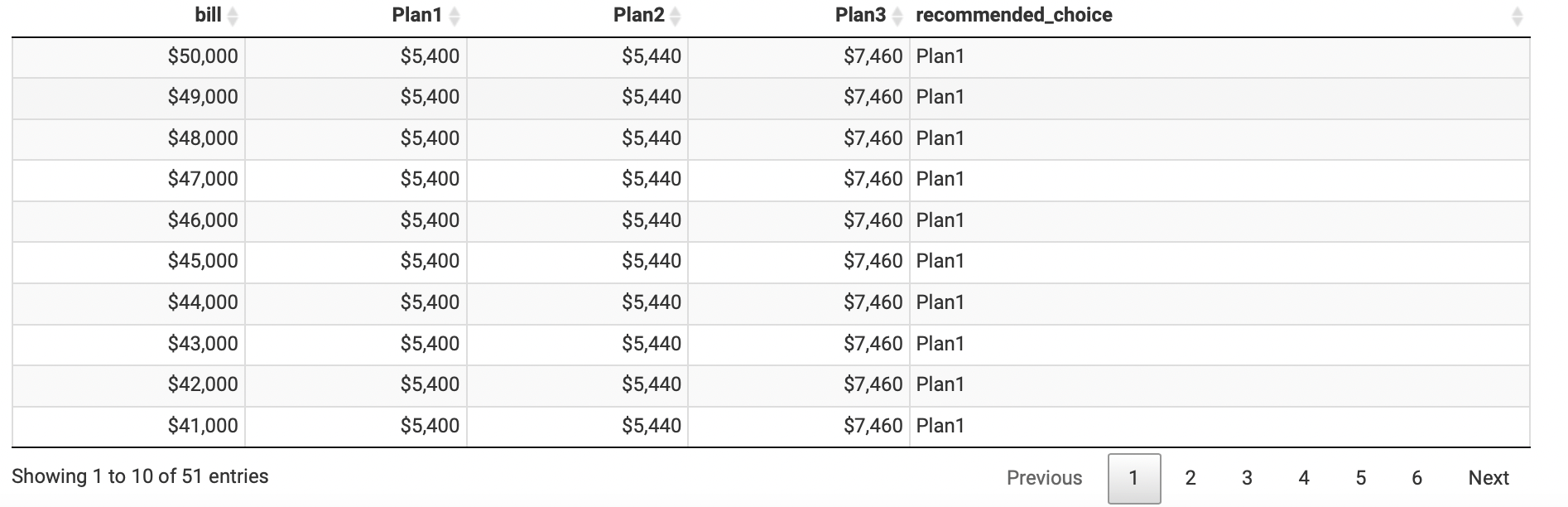

In case I need to read the actual numbers line by line, I can turn to the DT table below. The plan columns show the overall spending for each medical bill bracket. The recommended plan column would show the one with the least spending from my side.

Lastly

Please do not treat this as a financial recommendation as I only want to share this as an example of how R and shiny could help you in different scenarios. If you are interested, please feel free to check out the source code and modify this app for your own evaluations.